|

|

|

|---|

INDUSTRIAL HEMP VERSES THE D.E.A.

OF STERILIZED HEMP SEEDS AND OTHER SICK STORIES:

Most of us would think of Sterilized Hemp seeds as being a non issue, but as can be seen from the following (internal communications) from the DEA (then known as the Bureau of Narcotics), this was not at all the case. At least not to them.

With this kind of harassment “CONSTANTLY” taking place, it is of little wonder that the whole of the American Hemp Industry was put out of business. And note the year 1938 – Just in time for World War II.*

* See sections on World War II, aka the “Hemp for Victory” era elsewhere.

WARNING: Due to the quality of the original documents (found via the National Archives, College Park, Md.), transcribe errors are very possible. Also most pictures have been doctored for quicker download times. Please make reference to the originals for historical purposes.

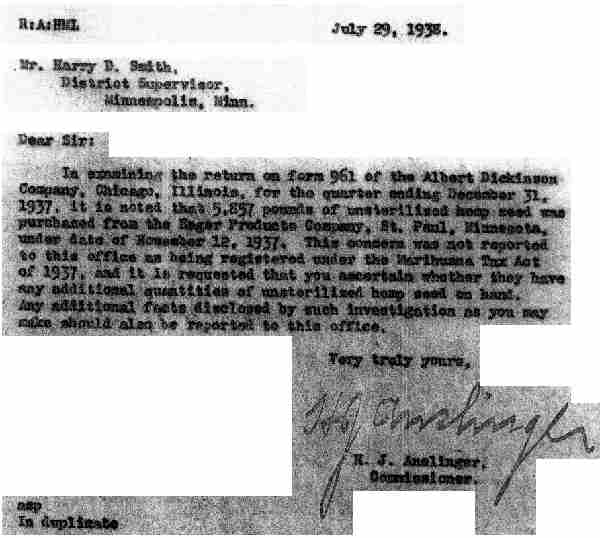

July 29, 1938

Mr. Harry D. smith

District Supervisor

Minneapolis, Minn.

Dear Sir:

In examining the return of form 961 of the Albert Dickinson Company, Chicago, Illinois, for the quarter ending December 31, 1937, it is noted that 5,857 pounds of unsterilized hemp seed was purchased from the Mager Products Company, St. Paul, Minnesota under date of November 12, 1937. This concern was not reported to this office as being registered under the Marihuana tax Act of 1937, and it is requested that you ascertain whether they have any additional quantities of unsterilized hemp seed on hand. Any additional facts disclosed by such investigation as you may make should also be reported to this office.

Very truly yours

(singed) H.J. Anslinger,

Commissioner

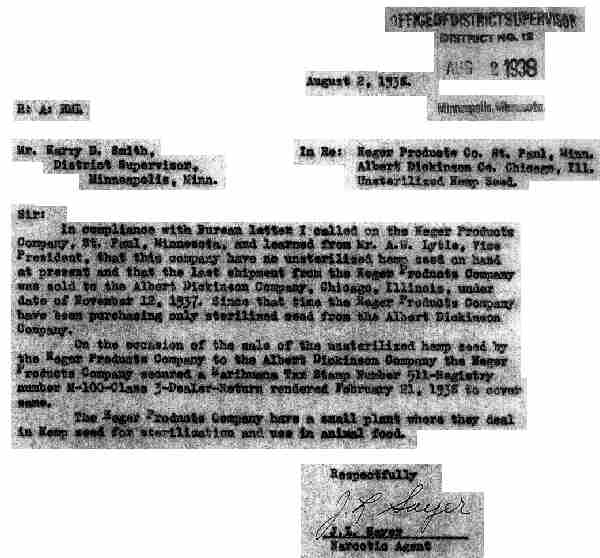

Aug 2, 1938

Mr. Harry D. smith

District Supervisor

Minneapolis, Minn.

In Re: Meger Products Co. St. :Paul, Minn.

Albert Dickinson Co. Chicago, Ill.

Unsterilized Hemp Seed

Sir:

In compliance with Bureau letter I called on the Meger Products Company, St. Paul, Minnesota, and learned from Mr. A.W. Lytle, Vice President, that this company have no unsterilized hemp on hand at present and that the last shipment from the Meger Products Company was sold to the Albert Dickinson Company, Chicago, Illinois, under date of November 12, 1937. Since that time the Meger Products Company have been purchasing only sterilized seed from the Albert Dickinson company.

On the occasion of the sale of the unsterilized hemp seed by the Meger Products Company to the Albert Dickinson company the Meger Products Company secured a Marihuana Tax Stamp Number 511-Registry number M-100-Class 3-Dealer-Return rendered February 21, 1938 to cover same.

The Meger Products Company have a small plant where they deal in hemp seed for sterilization and use in animal food.

Respectfully

(signed) J.L. Sayer

Narcotic Agent

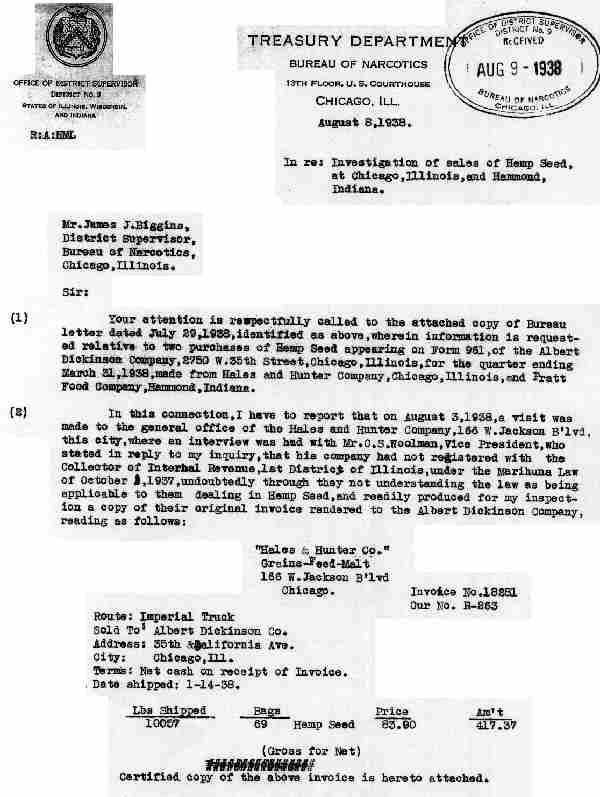

TREASURY DEPARTMENT

BUREAU OF NARCOTICS

13th Floor, U.S. Courthouse

Chicago, Ill.

Aug. 8, 1938

In re: Investigation of sales of Hemp Seed, at Chicago, Illinois, and Hammond, Indiana.

Mr. James J. Biggins

District Supervisor

Bureau of Narcotics

Chicago, Illinois

Sir:

(1) Your attention is respectfully called to the attached copy of Bureau letter dated July 29, 1938, identified as above, wherein information is requested relative to two purchases of Hemp Seed appearing on Form 961, of the Albert Dickinson Company, 2750 W. 35th Street, Chicago, Illinois, for the quarter ending March 31, 1938, made from Hales and Hunter company, Chicago, Illinois, and Pratt Food Company, Hammond, Indiana.

(2) In this connection, I have to report that on August 3, 1938, a visit was made to the general office of the Hales and Hunter Company, 166 w. Jackson blvd, this city, where an interview was had with Mr. C.S. Woolmen, Vice President, who stated in reply to my inquiry, that his company had not registered with the Collector of Internal Revenue, 1st District of Illinois, under the Marihuana Law of October 1, 1937, undoubtedly thought they are not understanding the law as being applicable to them dealing in Hemp Seed, and readily produced from my inspection a copy of their original invoice rendered to the Albert Dickinson company, reading as follows:

“Hales & Hunter Co.”He explained the difference of 51 pounds between the weight charged for 10057 pounds, and 10108 pounds reported by the Albert Dickinson Company, as representing the tare weight of the 69 bafs containing the shipment.

Grains-Feed-Malt

166 W. Jackson blvd

Chicago.

Invoice No. 18281

Our No. R-263

Route: Imperial Truck

Sold To: Albert Dickinson co.

Address: 35th California Ave.

City: Chicago, Ill.

Terms: Net cash on receipt of Invoice.

Date shipped: 1-14-38.

------------------ Hemp Seed

Lbs shipped Bags Price Amt 10057 69 83.oo 417.37

(Gross for Net)

Certified copy of the above invoice is here to attached.

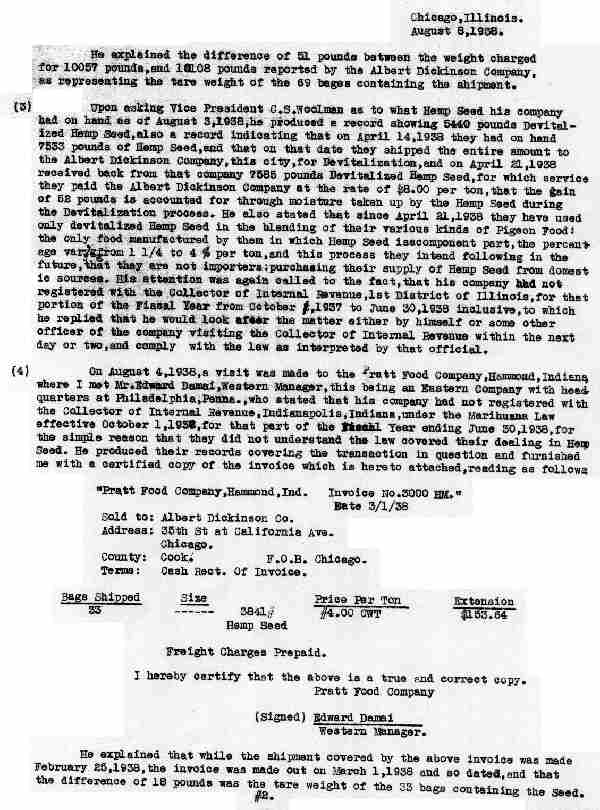

(3) Upon asking Vice President C.S. Woolman as to what Hemp Seed his company had on hand as of August 3, 1938, he produced a record showing 5440 pounds Devitalized Hemp Seed, also a record indicating that on April 14, 1938 they had on hand 7533 pounds of Hemp Seed, and that on that date they shipped the entire amount of the Albert Dickinson company, this city, for Devitalization, and on April 21, 1938 received back from that company 7585 pounds Devitalized Hemp Seed, for which service they paid the Albert Dickinson Company at the rate of $8.00 per ton, that the gain of 52 pounds is accounted for through moisture taken up by the Hemp Seed during the Devitalization process. He also stated that since April 21, 1938 they have used only devitalized Hemp Seed in the blending of their various kinds of Pigeon Food: the only food manufactured by them in which Hemp Seed is a component part, the percentage varying from 1 1/4 to 4% per ton, and this process they intend following in the future, that they are not importers: purchasing their supply of Hemp Seed from domestic sources. His attention was again called to the fact, that his company had not registered with the Collector of Internal Revenue, 1st District of Illinois, for that portion of the fiscal Year from October 1, 1937 to June 30, 1938

(4) On August 4, 1938, a visit was made to the Pratt Food Company, Hammond, Indiana, where I met Mr. Edward Damai, Western Manager, this being an Eastern Company with headquarters at Philadelphia, Penna., who stated that his company had not registered with the Collector of Internal Revenue, Indianapolis, Indiana, under the Marihuana Law effective October 1, 1938, for that part of the fiscal Year ending June 30, 1938, for the simple reason that they did not understand the law covered their dealing in Hemp Seed. He produced their records covering the transaction in question and furnished me with a certified copy of the invoice which is here to attached, reading as follows:

“Pratt Food Company, Hammond, Ind. Invoice No. 3000 HM.”He explained that while the shipment covered by the above invoice was made February 25, 1938, the invoice was made out on March 1, 1938 and so dated, and that the difference of 18 pounds was the tare weight of the 33 bags containing the Seed.

Date 3/1/38

Sold to: Albert Dickinson Co.

Address: 35th St at California Ave.

Chicago.

County: Cook. F.O.B. Chicago.

Terms: Cash Rect. Of Invoice.

3841#

Bags Shipped Size Price Per Ton Extension 33 - #4.00 CWT $153.64

Hemp Seed

Freight Charges Prepaid.

I hereby certify that the above is a true and correct copy.

Pratt Food Company

(Signed) Edward Damai

------------------------

Western Manager.

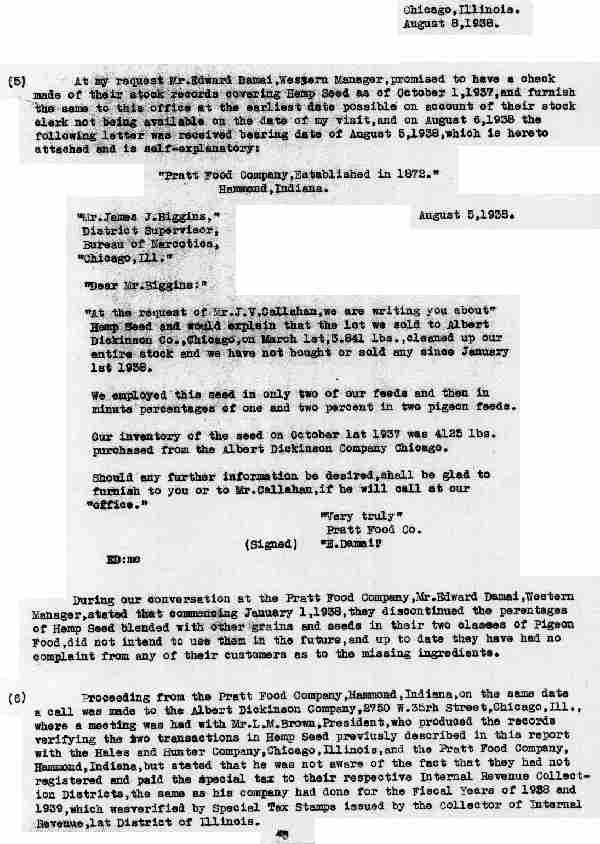

(5) At my request Mr. Edward Damai, Western Manager, promised to have a check made of their stock records covering Hemp Seed as of October 1, 1937, and furnish the same to this office at the earliest date possible on account of their stock clerk not being available on the date of my visit, and on August 6, 1938 the following letter was received bearing date of August 5, 1938, which is hereto attached and is self-explanatory:

“Pratt Food Company, Established in 1872.”During our conversation at the Pratt Food Company, Mr. Edward Damai, Western Manager, stated that commencing January 1, 1938, they discontinued the percentages of hemp Seed blended with other grains and seeds in their two classes of Pigeon Food, did not intend to use them in the future, and up to date they have had no complaint from any of their customers as to the missing ingredients.

Hammond, Indiana.

August 5, 1938

Mr. James J. Biggins,”

District Supervisor,

Bureau of narcotics Chicago, Ill.

Dear Mr. biggins:

At the request of Mr. J.V. Callahan, we are writing you about Hemp Seed and would explain that the lot we sold to Albert Dickinson co., Chicago, on March 1st, 3,841 lbs., cleaned up our entire stock and we have not bought or sold any since January 1st 1938.

We employed this seed in only two of our feeds and then in minute percentages of one and two percent in two pigeon feeds.

Our inventory of the seed on October 1st 1937 was 4125 lbs. Purchased from the Albert Dickinson Company Chicago.

Should any further information be desired, I shall be glad to furnish to you or to Mr. Callahan, if he will call at our office.

Very truly Pratt Food Co. E. Damai

(6) Proceeding from the Pratt Food company, Hammond, Indiana, on the same date a call was made to the Albert Dickinson Company, 2750 W. 35th Street, Chicago, Ill., where a meeting was had with Mr. L.M. Brown, President, who produced the records verifying the two transactions in Hemp Seed previously described in this report with the Hales and Hunter company, Chicago, Illinois, and the Pratt Food Company, Hammond, Indiana, but stated that he was not aware of the fact that they had not registered and paid the special tax to their respective Internal Revenue Collection districts, the same as his company had done for the Fiscal Years of 1938 and 1939, which was verified by Special Tax Stamps issued by the Collector of Internal Revenue, 1st District of Illinois.

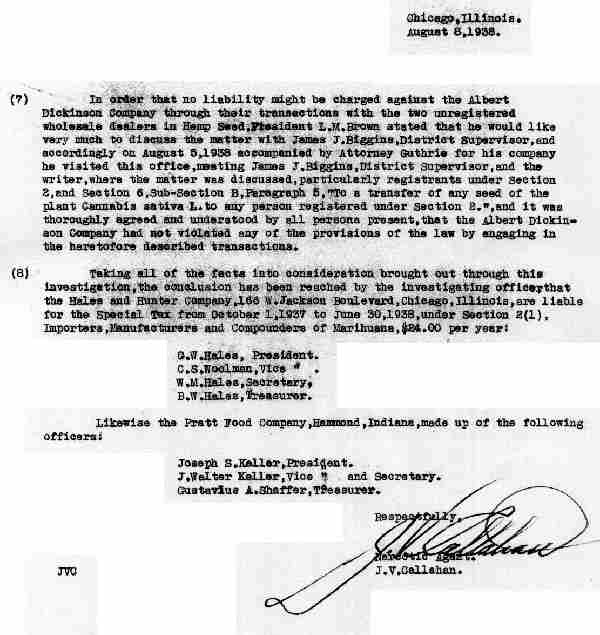

(7) In order that no liability might be charged against the Albert Dickinson company through their transactions with the two unregistered wholesale dealers in Hemp Seed, President L.M. Brown stated that he would like very much to discuss the matter with James J. Biggins, District Supervisor, and according on August 5, 1938 accompanied by Attorney Guthrie for his company he visited this office, meeting James J. Biggins, District Supervisor, and the writer, where the matter was discussed, particularly registrants under Section 2, and Section 6, sub-section B, Paragraph 5, “To a transfer of any seed of the plant Cannabis sativa L. to any person registered under Section 2.”, and it was thoroughly agreed and understood by all persons present, that the Albert Dickinson company had not violated any of the provisions of the law by engaging in the heretofore described transactions.

(8) Taking all of the facts into consideration brought out through this investigation, the conclusion has been reached by the investigating officer that the Hales and Hunter Company, 166 W. Jackson Boulevard, Chicago, Illinois, are liable for the Special Tax from October 1, 1937 to June 30, 1938 under Section 2(1), Importers, Manufacturers and Compounders of marihuana, $24.00 per year:

G.W. Hales, President.Likewise the Pratt Food Company, Hammond, Indiana, made up of the following officers:

C.s. Woolman, Vice

W.M. Hales, Secretary,

B.W. Hales, Treasurer

Joseph S. Keller, President J. Walter Keller, vice and Secretary Custavius A. Shaffer, TreasurerRespectfully,

(signed)

Narcotic Agent

J.V. Callahan

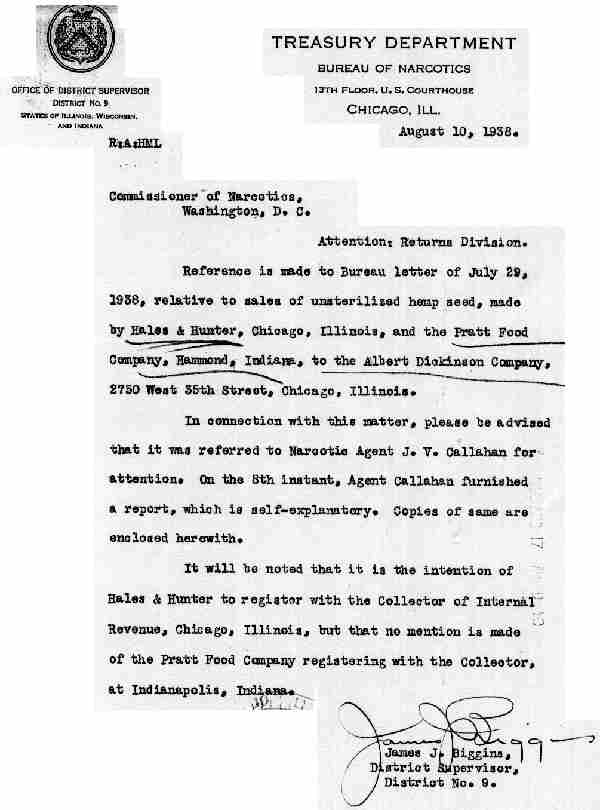

TREASURY DEPARTMENT

BUREAU OF NARCOTICS

13th Floor, U.S. Courthouse

Chicago, Ill.

August 10, 1938

Commissioner of narcotics,

Washington, D.C.

Attention: Returns Division

Reference is made to Bureau letter of July 29, 1938, relative to sales of unsterilized hemp seed, made by Hales & Hunter, Chicago, Illinois, and the Pratt Food Company, Hammond, Indiana, to the Albert Dickinson Company, 2750 West 35th Street, Chicago, Illinois.

In connection with this matter, please be advised that it was referred to Narcotic Agent J.V. Callahan for attention. On the 8th instant, Agent Callahan furnished a report, which is self-explanatory. Copies of same are enclosed herewith.

It will be noted that it is the intention of Hales & Hunter to register with the Collector of Internal Revenue, Chicago, Illinois, but that no mention is made of the Pratt Food Company registering with the collector, at Indianapolis, Indiana.

James J. Biggins,

District Supervisor,

District No. 9.

WANT TO KNOW MORE:

=====================

Due to space / download time considerations, only selected materials are displayed. If you would like to obtain more information, feel free to contact the museum. All our material is available (at cost) on CD-Rom format.

CONTACT PAGE

ILLINOIS BACK TO MAIN PAGE |