|

|

|

|---|

Part of a 1914 Federal Reserve Note Showing Hemp-Farming

THE ECONOMIC IMPACT TO OKLAHOMA'S TAX REVENUES

OF LEGALIZING MARIJUANA IN OKLAHOMA

2.0 - WHY THIS REPORT:

We’ve all read the headlines:

“Washington (State) expects to rake in about $730 million from sales of legalized marijuana over the next two years.” [1]But just how realistic are some of those headlines? Are they nothing more than wishful thinking on the part of (God forbid) the unwashed hippie. Or did they originate from seasoned economical professionals, experienced farmers, long time retailers, and others? In other words, people who know what they are talking about. This probably being the first report dealing with the subject, has sought to “OBJECTIVELY” examine the financial issues, using (whenever possible) real-world statistics to reach its concussions. However, in doing so, we’ve run headlong into some real world problems. All of them related to objectivity when dealing with a very emotional situation.

“Lawmakers argue legalized marijuana can remedy Kansas budget woes” [2]

“Marijuana advocates push for legalization as Illinois budget boost” [3]

“Could legalizing marijuana be a solution to Pa.'s budget woes?” [4]

2.0.1 - DEALING WITH THE GHOUL FACTOR:

Yes, yes, our veterans coming home from the wars are suffering from P.T.S.D. Cancer victims are undergoing the weakening effects of chemotherapy. Far too many patients are suffering from seizures, and an endless list of further ailments. Medical Cannabis has been scientifically proven time and again to be medically useful for these ailments, and so many more.

Rest assured that no one is trying to act like a ghoul, and undoubtedly one’s heart does go out to many of these medical victims. However, this report, by definition, deals SOLELY with the financial impact that full re-legalization of medical marijuana would bring, specifically, as regards to tax revenues and expenses to Oklahoma governmental agencies.

2.0.2 - THE OKLAHOMA OPAQUE FACTOR:

As many are profoundly aware, Oklahoma is one of the most “NON-TRANSPARENT” States in the Union. Simply put, there is either a total disregard for public data, or a complete conspiracy to keep it secret, or perhaps even both. A good example of this is provided by our “Department of Corrections”. In order to calculate the costs of marijuana incarceration, we need to know the exact number of prisoners doing time for marijuana related convictions. However, the Department of Corrections claims that it doesn’t know how many of its inmates are doing time for Marijuana.

How this can be possible is beyond the imagination. Be that as it may, the fact that the Department of Corrections doesn’t know (or claim they don’t know) the number of prisoners with marijuana related offences would normally have prevented the calculation of prison expenses for just that. Fortunately, as the result of a previous report, a copy of the prison data (via Oklahoma’s Open Records Act) had been obtained and an elaborate (as closed to a physical head count as possible) had previously been done.

Thus due to this report, we know that 4% of all prisoners (whose crimes all centered around marijuana being illegal) would not have even gone to trial as all their so-call crimes revolved around marijuana illegality. Also that another group (11.5%) were in prison for marijuana and some other real world offense. Which after being prorated means that 6.5% of our entire prison population would today not be in our State prisons had marijuana not been against the law. From this data we were able to derive the yearly per-inmate costs of State incarceration for all marijuana:

[(28,700) x (6.5%) x ($23,000)] = $42-MillionHowever, while this report was able to obtain these specific figures, it was not able to obtain all the statistical data needed for this report. For example, if you listen to those running the Foster Care system, no child is being taken away from their parents because of Medical Marijuana use. However, according to all we see around us, that answer simply isn’t correct. In fact, children ARE being taken away from Marijuana using parents, even if an established medical use is clearly present.

Whereas:

28,700 = number of prisoners incarcerated under state authority

6.5% = percentage of prisoners presently being incarcerated solely for marijuana

$23,000 = costs to maintain incarceration of each prisoner for one year. This is per State Representative Bobby Cleveland who is on the prison commission.

However, referencing the previously mentioned “Ghoul Factor”, this report interests itself solely in the financial, not the moral issues involved.

But how does one go about establishing exact figures when the data needed is unavailable? Obviously, one can’t and in these cases some amount of technical guess-timents (which are labeled as such) had to be made. Yet in other cases we’ve been forced to simply make note of the facts and declare it an “unknown” figure, to either be added or subtracted from the totals.

2.0.3 - THE NOT JUMPING TO FALSE CONCLUSIONS FACTOR:

To reiterate, this report has sought to stay as financially objective as possible. Borrowing a cue from the Bible:

“Question all things. Accept that which is true and reject that which is false” 1-TheseloniansAnd to that we should add, “…even when the facts (at least at first) make no sense.” For example, let’s look at the following two headlines.

“Washington (State) Rakes In Millions (over 70 million) From Pot Taxes In First Year Of Sales” -- from the huffingtonpost.comAt first, one may be confused. How can both statements be true? However after a more careful reading, you would recognize that one statement makes reference SOLELY to recreational Marihuana sales, while the other makes references to all forms of tax increases, including Industrial Hemp growth, recreational sales, the tourist industry, etc.

“Washington (State) expects to rake in about $730 million from sales of legalized marijuana over the next two years.” -- News Tribune [5]

2.1 - REFERENCING OUR PRESENT BUDGET DEFICIT:

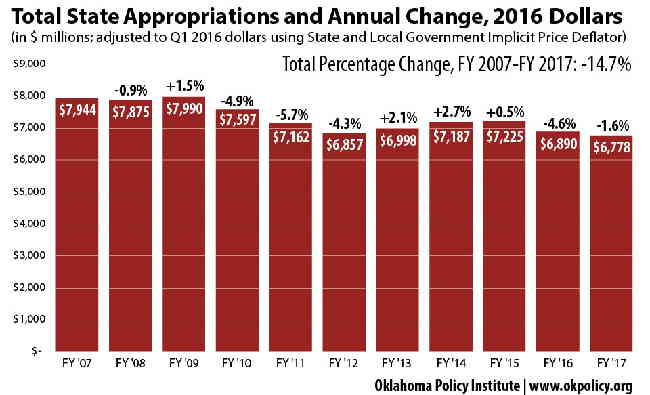

At the present time (2017), Oklahoma is facing state budget deficit of between a Half to almost One Billion Dollars for the coming year. Which as can be seen from the table below (the entire 2016 budget was only $6.9Billion) meaning that by Oklahoma standards, this is indeed quite a deficit.

[ask for permission to reproduce chart]

And while to the non-Oklahoman, the problem could easily be solved by raising taxes. Here in Oklahoma, thing are not so simple. People here seem to take following utterance quite literally:

“Tax monies are to politicians what opium is to an addict. They can never get enough of it, and no matter what, they always want more.”And indeed there is some truth to that expression. As experience has shown here, once a tax is put on the books (no matter how temporary it’s claimed to be), very seldom does it ever go away. And it can safely be assumed that this is something of which the Oklahoman voters are all too well aware. Or putting it another way, over here you couldn’t get elected dog catcher if it were known that you supported higher taxes. Thus, the state must look to other sources of revenues. Specifically by growing the economy, as opposed to finding news ways of taxing our existing one.

3.0 - WHY MARIJUANA:

One Willie Sutton was once asked, why do you rob banks; his (allegedly) infamous response was:

“Why, That’s Where The Money Is”Oklahoma, for good or bad, is economically over-reliant on the Oil Industry. When the Industry is up, tax revenues flow into the state coffers, lots of well paying jobs are created, lots of sales tax revenues flowed into local municipalities, etc. But when the industry is down that revenue stream sort of shuts down. Which is the situation we now (2017) find ourselves in today. And while much blame can be placed on past policies that have made us over-reliant on one industry, why didn’t we diversify ourselves while we had the chance? At this point, there is no sense in crying over spilled milk. Simply put, the price of oil has dropped by more than half over the past few years, and has yet to recover.

But again, we could either be finger pointing in an endless blame game, or we could be doing something about the situation. Which is what this report strives to do. As you will see, legalizing marijuana will do the following:

- Bring in to the State between $100-Million to $300-Million in direct tax revenues and direct tax savings

- Create a new multi-billion dollar a year industry.

- Create thousands high paying jobs (Farming, Hemp Mills, Transportation, Business Travel, etc.), that previously did not exist.

- Assist our farmers (and even ranchers) by providing them with an alternative high profit crop.

- And best of all, have the residual effect of keeping lots and lots of money, now being channeled into Colorado, right here at home.

Simply, put, it’s a win, win for the taxpayers, for the economy and for the future of Oklahoma.

3.1 - MORAL VALUES TRUE OR FALSE

FINANCIALS MATTERS TRUE OR FALSE

Most people, regardless of political or personal stance on the matter, no longer believe that marijuana’s full legalization is still an IF, AS OPPOSED TO A WHEN. This report seeks therefore not to argue re-legalization, but solely to document, the financial impacts (both negative and positive) that legalization will have on Oklahoma’s taxpayers. However, it would be negligence on our part not to at least mention the obvious: That there are those who are dead set against re-legalization - NO MATTER WHAT.

On paper, those who oppose legalization, almost exclusively (in fact, almost biblically) use moral arguments as their reasoning. However, as this is a financial report, it is of some interest to note that many of these in opposition seem to have personal financial interests in keeping the situation just as it is, regardless of the damage done. And to some extent, given our present economic situation, it is hard to blame them. Let’s face it, many of us today are only a dozen paychecks away from utter and total financial destitution. Thus, individuals whose jobs involve what has been termed the “Drug Enforcement Industries”, can’t really be expected to risk everything just for the sake of doing the right thing. Human nature, which the biblical references describe as being “jealously, lust and greed” [6] , just doesn’t work that way. Thus, the reader should take note that there will be various economic losers and actual tax revenues will be lost. (sec 4, this report)

And while one might be tempted to (at least at first), feel sorry for them, it should be noted that the economic losses do not even add up to 1% of the economic gains (Sec 4.5) that will be made within this state. As Former State Senator, Connie Johnson has said:

“It’s time to stop looking at the 1%, and start looking at ALL the others who will benefit.”Or more correctly stated; For every tax dollar lost due to legalization, the state treasury will actually gain ninety-nine dollars.

WANT TO KNOW MORE:

=====================

Due to space / download time considerations, only selected materials are displayed. If you would like to obtain more information, feel free to contact the museum. All our material is available (at cost) on CD-Rom format.

CONTACT PAGE

BUDGET REPORT PRIVIOUS SECTION |

|

BUDGET REPORT NEXT SECTION |

BACK TO MAIN PAGE OKLAHOMA BUDGET REPORT |